Forrester offered a splashy prediction recently: The End of Advertising! The more significant statement followed the comma: the “beginning” of customer relationships.

Not to split hairs here, but there was a time when companies routinely engaged in CRM (Customer Relationship Management) as a robust customer-centric business practice. That was before CRM was repackaged as an anemic plug-and-play technology solution.

Citing Forrester again, when customers are 75-90% through the buying cycle before a sales or marketing team is even aware of their interest, we have abdicated customer understanding and the beneficial relationships that could have been cultivated.

That finding was published in 2013, and rather than address the underlying problem, we continued to rely on tactics triggered to prompt a quick sale during customer contact.

However, customer relationships are neither established nor developed with a single interaction, or through a series of disjointed communications. Like any relationship (in real life or online), credibility, trust, value, and understanding are established over a series of progressive exchanges.

Display advertising never worked like we pretended.”

While many companies are not “beginning” customer relationships, it may be necessary to revisit, to reinvest, or refocus on the customer intelligence necessary to forge lasting—and valuable—relationships.

Moving companies away from the practice of pouncing on every interaction as a sales opportunity requires discipline: to selectively extract actionable customer-centric understanding across the continuum of interaction, and then reflect that understanding to support needs, and build symbiotic relationships.

Everybody plays. Everybody wins.

Let’s review the difference:

Unproductive Tactic 1: The Primacy and Recency Game

There was a time when “spray and pray” was a common communications tactic. Absent any understanding of who would buy the product or service and why, mass messages were delivered. It was a numbers play. The assumption was that response and spend would compensate for the cost of unproductive messaging.

Digital marketing made that tactic easier—and cheaper—to execute.

In a recent conversation, a friend noted, “digital marketing is often a Primacy and Recency Game.”

As people are more likely to remember the first or last option, companies haunt consumers with repeated exposure to previously viewed pages. This is another game of chance: relentless exposure increases the probability of products being first or last—at the right place should there be a right time.

The friend went on to point out, “There is no connection in this practice. It is empty communication. And the practice is too common to be effective, especially now, because people are turning off the noise.”

That conclusion is reflected in the projection that companies will reassign $2.9 billion of digital spend over the next year, since “Display advertising never worked like we pretended.”

Although it’s easy to pick on digital, this practice is not channel-specific. Companies email irrelevant messages daily simply to be top-of-mind. Social media is saturated with content generated solely to increase the quantity of impressions.

The challenge—and the irony—is that companies relying these tactics must continue to expel messages to remain top-of-mind, and yet with each release, they become less impactful, and more likely to be stopped at consumers’ request.

Irrespective of the channel, The Primacy and Recency Game reflects no customer understanding. By extension, it has little likelihood of establishing or cultivating customer relationships or the rich results.

Unproductive Tactic 2: Me First

Another tired tactic is the practice of turning every interaction into a sales opportunity.

I steel myself every time I go into my bank. I know that I will have to run the gauntlet of sales pitches and finger-wagging and unwelcome recommendations. My lack of interest is betrayed by the fact that I never asked for their input.

When I go to access my safe deposit box, it is a point of frustration that I must first serve their purpose: they must sell me something. I fully appreciate that a different savings account may be a better fit for me. I may well be interested, but not when they delay me, hold me captive, and ensure that I dread the next visit.

This may seem a bit dramatic because I am an adult who is capable of saying, “no.” However, when this adult has run through the polite versions of “no” and repeated requests just to get to the reason for my visit, I am put off. Memorably so.

It is off-putting because this customer’s needs are neither factored, nor prioritized, nor even heard. Instead, what matters is their objective: Always. Be. Closing.

Another example: the antivirus software fell off my laptop last weekend. I tried a few times to reinstall, and then uninstall and reinstall. No joy. Some frustration. So, I called the support line.

After collecting my contact details and confirming that I am a subscriber, the support person tried to sell me an upgrade.

Generally speaking, a point of failure is not the strongest sales position.

I am certain that both the bank and the software company associates were given direct instruction to sell, and input as to what I would likely buy.

Yet, their companies did not fully prepare these associates: they failed to consider the context of the interaction, the associates failed to acknowledge the social cues, and they failed to take “no” for an answer.

To paraphrase, the associates were only given hammers, and so all customers look like nails.

And so, they failed relationships.

I did not leave those interactions with a good impression, I did not think either was an adequate use of my time, and I did not feel valued. In short, I was discouraged from future interaction of any kind.

Their sole agenda was “Me First!”, overlooking the customer’s stated needs, leaving the customer to conclude, “Me Last.”

Unproductive Tactic 3: Sales Fast Forward

Years ago, a team member from one of the larger agencies told me about their work for a luxury car client. The agency had completed research that confirmed the high likelihood of purchase when prospects took the car for a test drive. That was terrific insight.

However, the agency decided to apply that intelligence to incent prospects to test drive the car, assuming that this single process step could fast forward the purchase of ~$60K car[1].

The underlying assumption was that a test drive was the only principal factor, or that it would serve as a substitute for the detailed decision steps typically preceding it.

In fact, the decision to purchase a $60K vehicle involves more than can be imparted even in a great test drive. That decision also occurs over time. Should the consumer be in a luxury car buying mood, they would define a consideration set. What makes this brand better than Mercedes? Or BMW? Or Lexus?

From there, models, features, gas mileage, cost of ownership, safety and performance records, resale values, dealership strengths—all would be considered. Price comparisons would be completed. And then there are the intangibles: what will the neighbors think?

In short, the decision is informed and reached along a process. And it’s a more complex decision than the Pepsi Challenge.

The agency also failed to recognize where the test drive typically occurs in the decision cycle: towards the end. So the net benefit of the agency’s tactic was perhaps to hasten the decision for prospects who had already completed the majority of their assessment—unaided.

The agency had created very meaningful insight. However, they did not develop the full intelligence. They did not consider how they could support prospects throughout their decision, establish trust and a relationship, and extend the value of that customer beyond their next automobile purchase.

This example predates (by at least a decade) the Forrester finding that customers are typically 75-90% through the buying cycle. I mention it here because it betrays so many practices that are still evidenced now: when customer understanding is absent, and when interactions have no context, companies focus instead on turning any interaction into a sale.

That can come at the expense of the customer relationship.

The Journey to The Destination

The challenge with the tired tactics described above is that they all singularly focus on the company’s end goal. However, when the purchase decision is more complex than gum at the register, customers often engage in multiple, hopefully progressive, interactions before concluding with a sale (or not).

The relationships companies develop will ultimately become annuities, predictably paying ongoing return.

Although these additive interactions may not represent immediate sales opportunities, there is unrealized potential present. Companies can support customers through the process, speak to their needs, impart quality, remove any barriers, gain trust, and establish relationships. With the customer intelligence that is developed through this process, value extends beyond the next purchase.

Of course, companies must understand both behavior and context, not just for customers generally, but also for different customer segments.

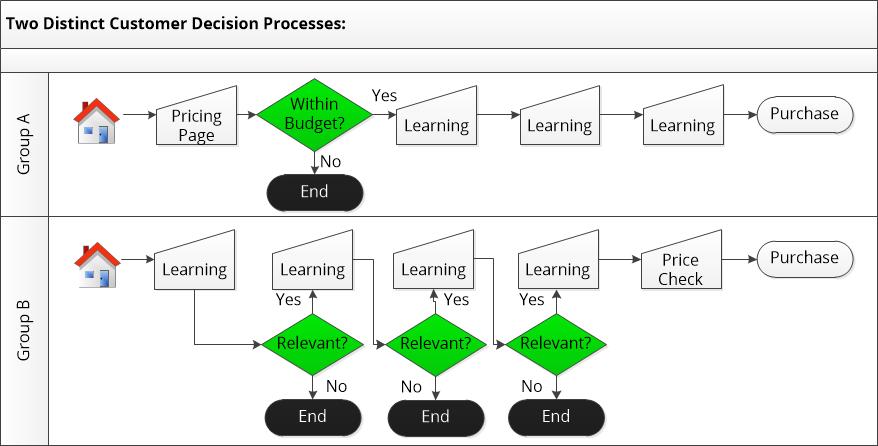

For example, analysis of prospects’ behavior on a client’s website revealed two distinct decision paths, but with a different order of operations:

Group A: checked the pricing page, and either immediately dropped, assumedly because they were price sensitive. If they did not drop, they continued educating themselves and eventually purchased.

Group B: educated themselves quite deliberately and could drop at any point in that process. If they did not, they finally checked the pricing page immediately preceding purchase.

The client could have engaged prospects when they checked the pricing page, assuming that this step, absent greater context, signaled purchase intention.

However, for the price-sensitive Group A, the decision was made. An attempt to prompt a sale for this group could have soured any future potential. Had the client reached out to Group B as they viewed the pricing page, they could have distracted that segment from completing a transaction.

There was significant benefit derived from this progressive and differentiated customer intelligence: while both led to the same end state, we knew how to manage both groups through their decision processes, removing objections, improving content and readability, and smoothing customer experience.

The applied intelligence led to increased sales for both groups.

With customer intelligence and context, prospects could be guided throughout their journey, not just pushed into a sale when they have managed 90% of the effort themselves.

That is really the opportunity for companies now: to break reliance on ineffective, quick-fix tactics, and realize the value and return possible from investing in relationships.

Where We Go from Here

$2.9 billion of ad budget is projected to be moved from under-performing digital spend this year.

I recommend that this budget should be invested in optimizing customer relationships.

“Invested” is the appropriate word because return may not be immediate given what must be accomplished: creating intelligence.

The required intelligence is both progressive and cyclical: companies must, at once, leave and pick up the bread crumbs to guide customers through decisions, and in turn understand what supports that process, and what does not.

Whether companies are beginning or refocusing on customers, the relationships they develop will ultimately become annuities, predictably paying ongoing return.

Would you like to discuss customer intelligence? Measurable strategy? Or how to meet revenue goals? Let’s talk! Set up a 30-minute phone conversation with Marina.

[1] I later received the incentive message which included a temptingly rich offer to take a test drive. The only issue: I wasn’t in the market for a new car.

Photo credit: Damir Kotoric