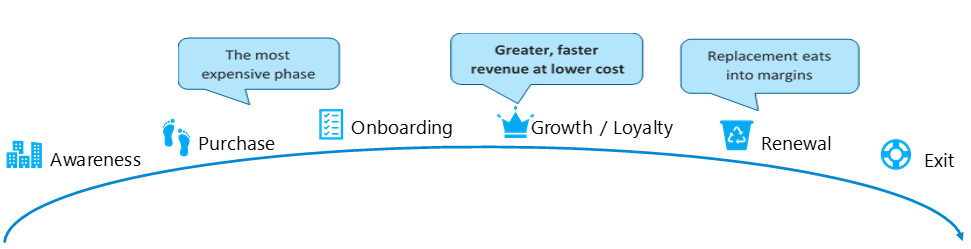

Often companies focus on driving that first transaction to acquire customers. They should. Those new customers bring incremental revenue. However, companies must remember that customer acquisition is only the beginning of what should be long and profitable customer relationships.

Companies that fail to engage newly-acquired customers will pay a high price to retain and/or replace lost customers.

Know Your Numbers

Customer acquisition is traditionally the most expensive of the lifecycle phases. Pick your multiple: there is research concluding that the cost is greater by 5-25x.

Here’s more reality: the first purchase always takes longer, and typically new customers spend less.

If customer acquisition margins are razor-thin margin or if it’s used a loss leader, that puts greater pressure on retaining and growing revenue from existing customers.

In this video, I detail the importance of understanding the costs of, and return from, the acquisition process.

Minimally, companies should know their customer acquisition metrics to inform their growth strategies through the customer lifecycle.

Know Your Prospects

Given disproportionate customer acquisition costs, understanding prospects is more important by 5-25x to control those costs.

That understanding should include their needs, what supports decisions, and how quickly purchase decisions are reached.

All that intelligence should be used to streamline marketing and sales tactics so that costs directly fuel revenue—and ongoing opportunity. Beyond incremental revenue, knowing your prospects will start the relationship off on a friendly note.

Build Customer Relationships & Revenue

A customer base should be a goldmine: current customers are cheaper to market to, they respond more quickly, and then spend more.

Because customer acquisition is only the beginning, companies must continue to engage customers and develop relationships. Ideally, companies should build on the customer intelligence they established in the acquisition phase.

Early intelligence should be used to create advantage so that new customers quickly become returning customers. Building that intelligence can perpetuate engagement—and reliable revenue, fatter margins, and significant return on investment.

Companies that abandon customers just acquired are doomed to repeat that step at their considerable expense.

As an example, I was involved in creating a predictive new customer lifetime value model (LTV) for a client. It described the behavior demonstrated by new customers who would ultimately become highly valuable long term.

We gained multiple benefits from this intelligence. Customer acquisition was better targeted and more cost-efficient, as we knew in which prospects to invest. We also knew which prospects to downgrade.

Revenue from the customer base became more reliable, cost-efficient, and greater. Again, we focused on customers that would continue to spend, and we did not invest in customers who would not[1].

Conversely, if companies interact without intelligence or worse, assume that their support ends when a customer is acquired, they could be effectively re-acquiring their customers with every transaction. That recurrent acquisition will always come at a higher cost.

Absent applied customer intelligence, effective strategies, and methodical measurement, companies can kill their own margins—and valuable customer relationships—from ill-informed tactics.

Watch the Exits

Customer acquisition comes full circle with customer attrition. That attrition can take place following the first purchase or following years of valuable loyalty.

Customer attrition informs customer acquisition because it defines the number (and type and value) of customers that must be replaced just to stay even.

If companies have a growth objective, even greater effort is required to reach it when customer attrition is high.

* * *

Customer acquisition is only the beginning in establishing profitable customer relationships.

Companies that abandon customers just acquired are doomed to repeat that step at their considerable expense.

However, companies that intelligently invest in growing relationships will realize the considerable benefits near- and long-term.

Would you like to discuss revenue growth? Or how to meet revenue goals? Let’s talk! Set up a 30-minute phone conversation with Marina.

Photo Credit: Raquel Martinez

[1] Full disclosure: testing and measurement continued so that we could identify new opportunities, add different customers, and increase revenue. Moving closer to your customers can be a continual process.