Customer acquisition is important because, of course, new customers increase revenue.

Customer acquisition is also typically the most expensive of the customer lifecycle phases.

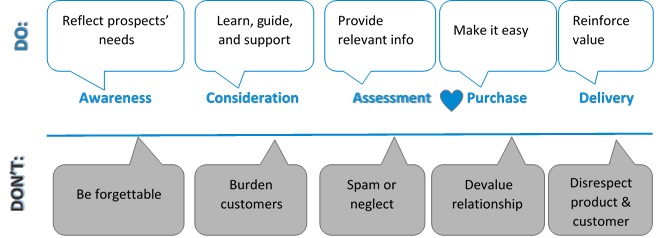

This crucial phase is about more than grabbing that first transaction. The true objective is to establish a lasting, mutually beneficial relationship.

Done right, customer acquisition will be cost-effective, and highly profitable near- and long-term.

A Deliberate Investment

Through acquisition messages companies also set expectations. When companies learn about their prospects and present relevant content supporting the first purchase decision, it will pay off with the opportunity to grow profitable relationships over years.

Less-is-more is at work as fewer informed messages reduce costs, speed acquisition, and create long-term opportunity and revenue.

Customers should become an annuity—and a reliable one.

Not a Smash & Grab

Companies that focus singularly on getting a transaction may make that first sale. Those customers will likely be one-and-done.

Companies that take a ham-handed approach to acquisition drive up costs, limit response, slow acquisition, and shrink margins and revenue.

Below we describe five common pitfalls that run afoul of efficient and beneficial customer acquisition.

1. Awareness

A decade ago, a Yankelovich study found that we are exposed to 5,000 marketing messages daily. Let’s assume that there is relevance somewhere in that ceaseless wall of noise.

This noise results from a tactical “spray and pray” practice, sending massive message quantities assuming that some will eventually find their target.

There is no strategy, no customer intelligence, no competitive advantage in evidence.

There is a cost consideration too. Digital channels make message carpet-bombing easy. However, the Data & Marketing Association (DMA) found that the cost to acquire (CTA) through digital is roughly equivalent to high-sunk-cost direct mail.

These “cheap” messages ensure that companies are forgettable at a premium.

The only way to break through the noise, engage prospects, and control costs is to understand customers’ needs and to directly address those needs.

Of course, that requires data-driven customer intelligence. For companies intending to efficiently acquire new valuable customers, that is table stakes.

2. Consideration

When a prospect is newly aware, they determine if they need or want the product or service. Depending on the risk or complexity, this can be a brief or a protracted step.

Companies must understand what is valuable to their prospects and exploit that insight.

This requires an ongoing learning process to recognize the needs of different segments, and how needs change over time.

Companies can fall victim to an “if we build it, they will come” approach. Laboring under this assumption, companies transfer responsibility and burden to the prospect, believing that prospects magically have perfect knowledge.

Remember the 5,000 daily messages? Perfect knowledge would have to be magical[1].

Years ago, I worked for a software company whose primary product had terrifically broad value. The value was so broad, however, that our Marketing team struggled to define its benefit.

Instead, a competitor positioned our product by its lowest commodity feature. We couldn’t move prospects’ perception from the misrepresentation.

Companies may have fantastic offerings, but if prospects don’t understand why they need it, that great product is wasted.

3. Assessment

Prospects evaluate specifications, case studies, competitors, and feedback, etc. all to inform a purchase decision.

This step occurs with complex decisions and low-risk purchases, like trying new Doritos flavors.

Companies need a deep understanding of how decisions are reached, appreciating the information required and how it is evaluated. Different segments may assess differently.

In B2B technology selection, for example, executive decision-makers require information in a different order than their technical colleagues. Executives consider business benefits first. Once they understand how and when the return occurs, they dig deeper. In contrast, technical decision-makers start with specifications to determine if the solution is sound. Then they will move on to other information.

Knowing who needs what information and when will speed the decision cycle.

In contrast, companies often assume that every interaction = purchase intention and launch masses of undifferentiated messages that badger prospects to buy!buy!buy!

By serving content based on clear understanding, companies affirm that they intend long (ideally profitable) relationships.

4. Purchase

Transactions should be simple and effortless.

If the prospect must struggle to give companies their money, the relationship begins by devaluing it.

5. Delivery

When delivery is executed well, the new customer is validated. Companies must respect both their new customer, and the product or service. If either is devalued, all the previous wins can be undone.

For example, I made a first purchase with an online pet supply company that promises discounts and convenience. My order was packed badly and so items were damaged. The company gleefully provided replacements “at no cost to [me]”.

However, I had already paid for the damaged products. They failed to respect their products and my time, and the result was no benefit.

* * *

Applying customer intelligence will drive down costs and speed the customer acquisition process.

That same customer intelligence can also pay off long-term. When customers appreciate that companies understand and serve their needs, those customers can become a highly profitable annuity.

It is important to remember that prospects are in control. They decide what and when. While they may take the steps above in a different order, each objective should be met.

The result can be an engaged customer base that creates reliable return.

[1] Remember too that Kevin Costner heard voices.

Would you like to discuss customer acquisition, growth, or retention challenges? Or how to make data work for you? Let’s talk! Set up a 30-minute phone conversation with Marina.

Photo Credit: Craig Whitehead