To drive revenue growth, especially now, every company needs to understand how its customers interact, beginning with awareness, through repurchase, and when and where they may exit.

If companies focus only on the milestones, they can’t effectively guide customers to their next purchase which boosts top- and bottom-line revenue.

Disjointed customer experiences are a major culprit of poor retention—and therefore low revenue and lifetime values.

We’ve measurably grown top- and bottom-line revenue, lowered acquisition costs, increased renewal and lifetime value—all from holistic customer understanding.

This excerpt from my recent conversation with Ronald C. Pruett, Jr. tells you how.

Current Customers Drive Revenue Growth Fastest

Ronald C. Pruett, Jr.: Whether companies are in turnaround, steady decline, or plateaued, it’s universally true that the fastest path to revenue growth is by increasing sales to current customers.

Marina Erulkar: The economics are compelling. Current customers simply drive greater, reliable revenue faster.

They respond more quickly and more often. They spend more on average.

While acquiring new customers is important, companies grow revenue, and hit their goals sooner, when they focus on current customers.

Understanding Customers’ Needs & Behavior is Vital

RP: But companies don’t realize those benefits if they don’t understand customers—and how to serve their different interests and needs.

MRE: I conceived the Optimized Revenue Growth℠ (O.R.G.℠) methodology because most companies have KPI’s and metrics that describe big milestones. Often those metrics are important to the company but don’t tell you about the customer.

For example, companies may measure customer acquisition and renewal rates.

But so much goes on with customers between those two milestones.

If companies don’t understand customers’ movement between milestones, then they can’t continue to engage customers. They can’t build intelligence about customers’ interests and needs.

They can’t be effective in increasing sales to those customers. They won’t be efficient when they do.

By extension, they can’t grow revenue at lower cost.

It just gets worse: when companies don’t effectively engage their customers, they often lose them. That puts companies in perpetual—and expensive—customer acquisition mode.

Especially now, companies must be selective about where they commit time and budget. We’re able to shift quickly from building new customer understanding to profitable action.

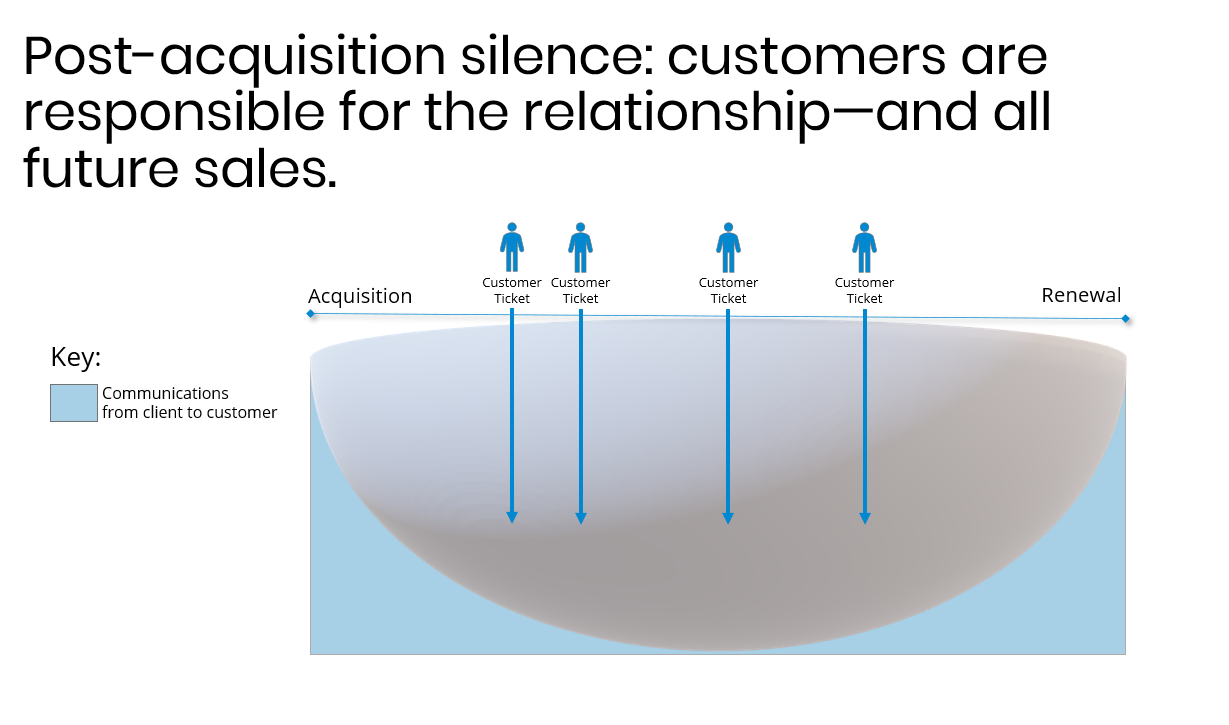

RP: We saw that with the subscription model company that was struggling to renew customers. Let’s call them RenCo.

They ignored customers after the sale. The only interactions were with Support, and of course, customers initiated those calls.

If those Support calls didn’t go well, there was no positive experience to counter the negative.

And so, from neglect and poor experience, the customer attrition rate climbed.

That set revenue in steady decline.

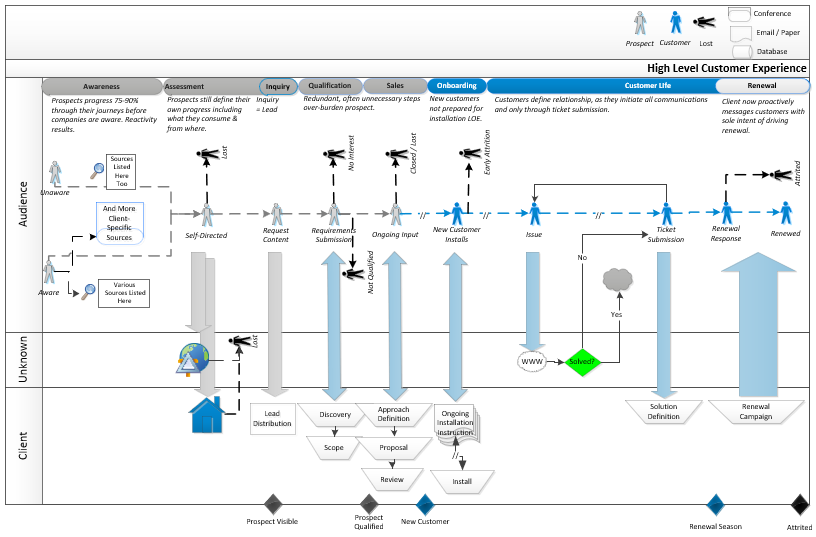

MRE: RenCo highlights the need to appreciate customers’ progression through a company end-to-end: from awareness through purchase, growth, and any exit.

With Optimized Revenue Growth℠, I find points where customers progress fluidly.

I also find points where customers drop out—or are forced out.

Customer Understanding Must Span the Organization

RP: That cross-organization perspective is significant because, typically, customers’ end-to-end interactions aren’t with one group. So, customers’ interactions aren’t known or understood across the organization.

RenCo underscores the negative impact: an issue created in Support was felt downstream by the Renewal Team.

The Renewal Team wasn’t aware and certainly didn’t know the root causes of attrition.

Being unaware of what happened with those other groups, they couldn’t undo the bad experience from months before—if that were even possible.

So, they couldn’t plug the revenue leak.

Revenue declined as customers attrited.

MRE: That’s where the customer experience mapping component of my methodology is uniquely valuable.

I identify those points of revenue leakage or opportunity throughout customer experience, and across different groups or divisions.

That way clients understand holistically how discrete actions or decisions affect the entire customer experience—and the client’s ability to grow predictable revenue.

Back to the RenCo example, mapping revealed the attrition driver that began well before the Renewal Team’s efforts started. With that insight, we devised an engagement strategy that nurtured customers post-sale.

Another revenue benefit: the new strategy meant that the Renewal team didn’t have to rely on their go-to discounting tactic—another way they cut into margins.

RP: We increased revenue significantly from that insight.

And with that greater insight to customer experience, it was quickly clear where to lower costs too.

I don’t know any other method that delivers such actionable strategy and increases revenue so quickly and reliably.

Shift Quickly from Informed Strategy to Profitable Action

MRE: The intelligence that comes out of the methodology is specific to the client’s business.

Instead of being theoretical, strategies and tactics are quickly actionable because they are tailored for the client’s environment, objectives, and resources.

The assessment and solutions are delivered with visually impactful maps of customer experience, so clients immediately understand the points of opportunity and risk.

Because I quantify the revenue that can be gained by seizing opportunity or stopping the leaks, I prescribe what clients should do first, second, etc., to drive the greatest revenue faster, and for the least, if any, investment.

It’s typically three months from assessment to actionable recommendations.

RP: The different perspectives from the mapping component have proven extremely valuable.

Again, back to the RenCo example, the 10,000-foot view depicted the root cause of declining revenue: the long, expensive silence between purchase and renewal.

The root cause of declining revenue was understood—and is depicted here—through the mapping exercise.

The customer experience summary underscored how and where customers did the heavy lifting—and how that affected purchase and renewal—and revenue.

Summary assessing customer experience—and opportunities to grow revenue & lower costs—end-to-end

Then the boots-on-the-ground view revealed what customers experienced in the scant interactions they initiated: long resolution times, inconsistent service, etc.

All were invaluable in effectively engaging those customers to boost the renewal rate and revenue.

The occasional survey or call center recording doesn’t nearly capture the clarity and the process that prospects and customers take with a company, how to plug any gaps that may exist, and where revenue is left on the table.

MRE: And in the tradition of less is more, from those mapped representations, I’m able to rationalize, streamline, and simplify customer engagement.

I use the same insight to address any gaps or redundancies as clients serve their customers. By aligning customer-facing operations to what customers need, clients realize greater efficiency that improves their bottom line.

For example, that makes customer acquisition faster and more cost effective. Growing spend for current customers gets easier and boosts lifetime value.

RP: Especially now, companies must be selective about where they commit time and budget.

Many customers are just not in the mood to buy or be sold—anything. So, the focus must be on providing the best, supportive, relevant experience possible. That begins by understanding what customers need and how they want to interact with you.

Understanding needs and the sequence of customer interactions is made far easier through the O.R.G.℠ mapping process.

So, clients understand where to focus and what to do to drive reliable revenue quickly.

They know those costs and activities to suspend because they don’t drive ROI.

With this method, we’ve had measurable success driving greater revenue at lower cost.

For every company in turnaround, or with declining or stalled revenue, this is the fastest way to reverse the trend and grow predictable revenue.

If your revenue has stalled or declined, and you need expertise to quickly reverse the trend & drive efficient revenue:

This was a conversation between:

I create data-driven revenue growth strategies for mid-sized companies. My clients gain greater revenue and lower costs. I frequently uncover unseen revenue sources.

I begin with a proprietary assessment that combines quantitative, qualitative & process.

The resulting recommendations are quantified and prioritized so you will gain the greatest revenue sooner with the least, if any, investment. Clear plans ensure that teams can quickly execute.

Engagements are typically completed in under three months.

(Some clients ask that I contribute through execution. I’m happy to continue if that’s helpful.)

The result for my clients is greater, reliable top- and bottom-line revenue. And a growing business.

Ron is Managing Partner of The Boston Associates.

He operates and advises direct to consumer (DTC) brands, digital commerce platforms, TV entertainment companies, and their investors worldwide.

Global experience across launch, growth, acquisition and turnaround stages. Founder, CEO, CMO, Board Director and Advisor roles, for publicly traded and privately backed marketing-led companies and consumer internet brands.

He graduated with a B.A. (Honors) in International Relations and Political Science from Trinity College in Connecticut and received his M.B.A. from the École Européenne des Affaires (now ESCP Europe), a French Grande École located in Paris, France where he graduated as Valedictorian.

If you need a revenue growth strategy to get you through this quarter and to a future goal:

Photo credit: Ardito Ryan Harrisna