There are moves that every company should consider now to drive revenue—even growth—when it’s not business as usual, even amidst so much uncertainty about COVID-19, and how it impacts us personally and professionally.

This is not the time for inaction. It’s not the time to do anything for the sake of doing something. It’s not the time to be reactive: that’s expensive and it rarely works.

Among the uncertainty is opportunity: with informed focus now, companies can become leaner. They can build on what drives efficient revenue and stop what doesn’t.

As important, we must also focus on what is certain: recovery is coming.

History offers examples of companies that were able to drive revenue growth from informed strategy during economic downturns.

It may also be possible to use your recovery to build something bigger than business as usual.

I guided clients to manage and grow revenue through the recession. One of those clients historically served a collapsing industry. My strategy doubled revenue to $1 billion, de-risked the business, expanding the industries they serve which made them more resilient.

To build revenue and ensure that uncertainty doesn’t have its way with us, companies should undertake a two-pronged effort now:

1. Actively manage current revenue and costs

2. Prepare to seize opportunity as soon as your recovery begins

Following is an overview of the related activity to drive revenue (even growth) now and at recovery. Why wouldn’t there be a caveat? Every industry, every business is unique. The details matter, especially now. Please accept what follows as general guidance, not a checklist.

1. What to Do Now to Drive Revenue (Even Growth)

When business is humming, it’s natural to operate from habit because “we’ve always done it that way”. Depressed revenue may not be obvious, it’s easy to tolerate inefficiency, there’s no urgency to address unproductive costs.

In a downtown, don’t just rearrange the deck chairs. Assess the ship and where it’s going.

Here’s an example: I worked with a client who was tasked with doubling revenue without adding proportionate resources. It sounded impossible, especially during a recession.

From my assessment, I found numerous opportunities to increase revenue while lowering costs. Among those opportunities was redirecting one team member who spent all day every day tending technology. Without exaggeration, she pressed a button.

To address this inefficiency, I recommended a digital solution that freed the team member for high value customer interactions.

The technology was self-funding and the client gained a resource without added cost.

Unless you look closely, business as usual can sink you.

Economic turbulence can fuel the clarity to amplify what drives efficient, reliable revenue now, and end what inflates costs and returns meager margins.

Following is general guidance that could shape your approach.

Assess & Manage Current Revenue Sources.

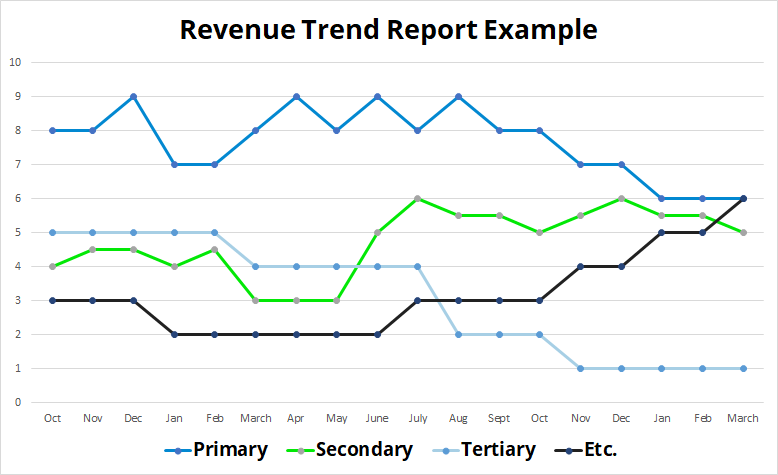

You’ll need a clear understanding of the current state of your revenue and how it’s trending so that your actions sustain your business, drive revenue and even growth.

Begin by creating a report (or review an existing one) that details top-line revenue by source, amounts and percentages. Ideally, the report is monthly, going back ~18 months.

First review the trend in your primary revenue source and determine if it’s stable, increasing, or decreasing.

The answer will inform your next steps and whether you should amplify (where revenue is stable or increasing), or address or compensate (where revenue is decreasing).

Ask yourself—and discuss—a series of questions such as:

-

Will this revenue sustain us?

-

What are the root causes of any inflection points? Are they internal? External? Both?

-

Can we exploit (the positive) and/or reverse (the negative)?

As an example, I worked with an organization whose revenue was in steady decline. By their own projections, they had only a few years remaining. Their solution was to add new revenue sources.

However, my assessment revealed that any growth was wholly reliant on their primary revenue stream.

From that key insight, my strategy and work plan first refocused them to stabilize and grow primary revenue. All incremental revenue was cultivated in later phases.

The only way to secure their future was to focus first on the revenue stream that was vital to it.

Now look at the trends for the remaining revenue sources. They provide options to increase, compensate, or suspend.

Next create a variation of the original report, this time with bottom-line revenue. This will give you an overview of how costs are applied.

Going forward generate these reports regularly, adding weekly numbers minimally.

Review—and discuss—these reports continuously. I recommend a daily habit that also includes historic trends for nimble response to both issues and opportunities.

Examine Costs.

This may seem obvious but identifying, and reducing or eliminating unproductive costs drives straight to the bottom line.

You may discover multiple vendors providing redundant services, for example, or unused technology.

Suspending those expenses returns budget that extends your runway or can be used to drive revenue (even growth) effectively.

Focus on Current Customers.

Especially now, companies should focus on current customers. They respond more quickly, and more often. They spend more on average.

Current customers are every company’s greatest source of reliable revenue at lower cost.

A steady & predictable revenue stream derived from keeping and growing customers empowers companies to confidently grow. It takes them out of expensive, and ineffective, reaction mode.

There’s a condition, however: customer intelligence. Companies must understand different customers’ needs, their value drivers.

End-to-end across the customer journey, companies must inform and support decisions, and resolve issues quickly and professionally, all to ensure additional purchases, renewal, greater revenue, and ROI.

In contrast, even in the best of times customer acquisition is a longer cycle and more expensive by 5-25x.

Our current environment compounds that challenge because customers’ decisions have greater significance now. They are more considered. That only increases customer acquisition costs and delays.

And uncertainty.

Current customers are every company’s safest investment to quickly return reliable revenue.

Cultivate Customer Loyalty.

Companies have an opportunity now to distinguish themselves by how they support customers through their journeys. Those that appreciate and effectively serve customers’ needs will establish good will, ideally cultivate loyalty—and leave a lasting positive impression.

But they may not always prompt an immediate purchase.

Both B2B and B2C purchases are more considered now. Decision cycles are likely longer.

That doesn’t negate interest or the intent to purchase.

But that’s always true. Even in the best of times, customers may delay a purchase of a needed item, for which they’ve budgeted, after choosing among competitors, etc.

When times are good, it’s easy for companies to ignore those that don’t purchase quickly and focus on those that do.

Our current environment creates the opportunity to refocus: to develop lasting impressions, to establish and build loyalty whose value lasts well beyond the next transaction.

Companies may not recognize loyalty if they value customers only by spend. A customer may be optimized at modest spend levels, but their value can extend well beyond direct revenue.

Loyalty can be slippery though, as companies can have different indicators. One company’s loyal customers may be active advocates. Another’s may rebuff all competitors and substitutes.

If companies don’t factor loyalty, as challenging as it is, they will lose advocates in the most valuable leg of their customer journeys.

Customer loyalty quickly becomes durable competitive advantage. And drives reliable revenue.

Assess Practices.

Examine normal business operations especially those that support customers. Identify any redundancy or inefficiency that may have a negative impact on customers and/or revenue.

Rationalize and streamline those practices so that they serve customers’ needs efficiently and make better use of budget.

I was engaged to reverse a revenue decline. Among the issues I uncovered through my proprietary assessment was early customer attrition.

New customer onboarding was managed by one resource who worked long hours executing a series of unnecessary steps that also overwhelmed customers. So, after a long and costly sales cycle, new customers cancelled contracts.

For numerous reasons, those cancellations went unnoticed. Revenue dropped, Sales’ targets were set farther back which swelled costs. Sales pressure increased just to stay even.

Business as usual was suppressing hard-won return.

I rationalized and digitized the process to relieve both customers and the resource.

The early attrition rate dropped, revenue increased, and the resource focused on value-add efforts.

Align Sales & Marketing.

Companies with well-aligned teams can achieve 20% annual revenue growth. That unity can even sustain revenue through economic downturns. Some companies even thrive through turbulent times.

By uniting their existing teams, companies can lower costs, increase efficiency & grow sustainable revenue.

Conversely, companies with divided Sales & Marketing teams lose 10% of annual revenue to that misalignment. Cumulatively, that’s a $1 trillion annual loss for US companies in the best of times.

To learn more about the top- and bottom-line benefits of aligning Sales & Marketing teams, click here.

2. Strategize for Your Recovery

Now is the time to plan your recovery. Without question, it is coming.

Consider that this could be the time to redesign your business. With so many industries affected, much will be in flux—which opens opportunity for companies who strategize now.

And that opportunity may be substantial: to capture market share from competitors who fail to plan, to enter new markets, to serve new customers, etc.

Think beyond returning to business as usual.

Planning now will ensure that take gain full revenue advantage. As workplace engagement expert, Janet Swaysland said, when driving “you accelerate into the turn” so that you don’t sputter through.

During the great recession, I defined the revenue growth strategy for a client who was tasked with doubling revenue to $1 billion within five years. Compounding the challenge, the only industry they served was collapsing.

I conceived a data-driven strategy that first identified the growing segments in the industry they served. I then projected the revenue that could be derived from targeted industry and global expansion.

The board approved the strategy, and recommendations that were prioritized to return the greatest revenue from the least investment.

The client hit their revenue target early.

As important, they de-risked the business. By serving diverse industries, they became more resilient, opening additional sources to drive sustainable revenue growth.

They freed themselves from previous limits to expand their business and amplify sustainable revenue.

As important, plan to be nimble. Plan up front so that there’s brain space during implementation to recognize, assess, and seize opportunity.

Once again, details matter. Please accept what follows as guidance, certainly not a complete checklist.

Ask the Big Question.

Consider the vast space that may be opening. This could be the opportunity for profitable expansion, redirection, and/or reinvention.

Take the opportunity to consider that scope and ask the big question. It could be: “What business should we be in?”

Or maybe your big question is different, like “Which industries should we serve?” Or, “Which customers should we target?” Or “Can we boost competitive advantage?”

The point is that this is a unique moment to consider the full scope of what is possible.

As with my client, it may be an enhanced, more resilient business, with greater revenue in the multiples.

It may not be optimal to go back to business as usual.

Taking Shape.

Industries and companies will experience recovery differently in terms of both timing and trends. Some will bounce immediately, experiencing recovery in a V-shape. Others will experience a gentle U-shaped recovery. Others will sit in an L.

The shape of your recovery will inform your strategy, when you begin and how you execute. It will inform priorities, progression, and how/if you scale.

Begin by running scenarios that project the shape of your recovery.

Another caveat: none of us can predict the future, so staying nimble returns real value when navigating the turn.

Strategize & Plan.

Your specific strategy will be informed by the opportunities you’ve identified and your intentions for your business. Your strategy will be influenced by the timing and shape you project for recovery.

Begin by defining success what looks like. If possible, quantify what you’ll achieve.

Next, set your objectives. That may be market expansion or growing your customer base.

Define the plan that details how you’ll achieve your objectives. Include any dependencies and required resources. Also consider how you’ll scale if you’ll have to hire or expand.

Break your plan into phases. I begin with 30/60/90-day plans so that immediate action is clear, as is the path forward.

Once you’ve drafted both strategy and plans, confirm that they support your success requirements and your objectives.

Measure Success.

As part of your planning, define the appropriate measurement plan to include KPI’s, metrics, and analysis.

This will help you stay nimble and respond to both opportunity and the need to correct.

Know Your “Go!”

Define what factors or signals that must be present for you to begin executing your recovery strategy, so you’ll know when to accelerate into your turn.

We are all feeling the impact of COVID-19 in our homes and with our businesses. It’s understandable that we may be stunned by the uncertainty.

While it may seem prudent to wait or stay the course, inaction or business as usual may sacrifice greater revenue, new opportunity, and/or a more resilient business.

Business as usual could have the net effect of rearranging the deck chairs.

Every company that pushes past uncertainty and takes the right action now—actively managing revenue, planning to capture full potential from recovery—will gain tremendous, lasting competitive advantage.

By focusing deliberately, companies can drive predictable, sustainable revenue—even growth.

They will build something far more valuable than business as usual.

About Marina Erulkar

I devise strategies to achieve your company’s objectives, whether that’s:

✔️ Reach a growth objective (like doubling revenue)

✔️ Reverse a revenue dip or drop

✔️ Scale the company

✔️ Increase & speed customer acquisition, growth & renewal

✔️ All of the above

My strategies are effective because they’re specific to your business, your customers, and your circumstances, environment, and resources.

I pinpoint revenue opportunities & revenue leakage across your company. I often uncover new revenue sources in the process.

Then, I develop data-driven strategies that grow your revenue quickly, and as you progress to your larger goals.

For my clients, I quickly turn declining revenue into steady revenue growth.

Purposefully. Confidently. Effectively.

If you need a comprehensive strategy that factors current realities & directs you to grow predictable revenue, contact me.

We’ll schedule a free consultation to see if I can help.

Photo credit: Alex Perez